blog

The Future of FinTech: AI's Role in Transforming Financial Services

By Mohan S Business Software development Digital transformation AI and ML November 1, 2024

McKinsey reports that as of 2024, at least 72% of businesses use AI for one or more operational tasks.

FinTech is also evolving rapidly, and AI is at its forefront, reshaping how financial services operate. By integrating advanced algorithms, machine learning, and automation, companies are optimizing processes like risk management, fraud detection, and personalized customer experiences.

AI’s impact is transformative, enhancing efficiency, accuracy, and customer satisfaction. With real-time data analysis and decision-making capabilities, AI addresses industry challenges, offering financial institutions the tools they need to stay competitive and innovate.

AI & FinTech: Market Overview

The financial environment has been completely transformed by AI applications such as chatbots, risk assessment, fraud detection, and automated trading.

For example, a report from McKinsey suggests that AI has the potential to generate up to $1 trillion in value for the global banking industry each year. This value comes from enhancing customer interactions and improving operational efficiencies.

You may also like to read: Blockchain Technology in Banking

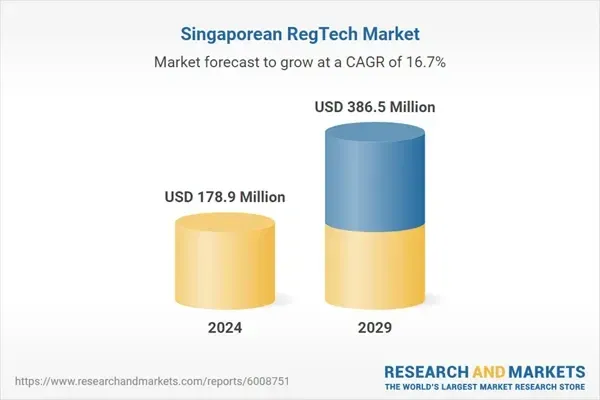

One noteworthy aspect of this growth is RegTech, a specialized subset of FinTech that focuses on using AI to manage regulatory risks, reduce costs, and streamline compliance processes. RegTech leverages advanced technologies to provide tools for data management, reporting, and real-time monitoring, which significantly improve compliance efforts and lower error rates.

(Source: https://uk.finance.yahoo.com/news/singapore-regtech-business-investment-opportunities-092500522.html)

According to a recent report, the RegTech market in Singapore is expected to grow from USD 178.9 million in 2024 to $386.5 million by 2029, reflecting a compound annual growth rate (CAGR) of 16.7%.

This shows the increasing importance of regulatory technology in the financial landscape, where compliance is becoming more complex and resource-intensive.

Benefits & Applications of AI in FinTech

The use of AI in FinTech has completely changed the field, providing powerful tools for improving efficiency, safety, and customer engagement.

Let's explore key areas where AI drives significant benefits:

Fraud Detection and Prevention

Artificial intelligence (AI) improves security by continuously observing and evaluating transactional trends to instantly identify questionable activity. Quick adaptation to new types of fraud allows machine learning models to decrease false positives and speed up response times.

RegTech systems with AI capabilities also automate compliance monitoring, reducing the risks and expenses related to manual checks while guaranteeing compliance to regulatory requirements.

Customer Service (Chatbots and Virtual Assistants)

AI-powered chatbots and virtual assistants make banking more accessible by offering 24/7, personalised customer care.

These technologies provide a smooth and effective user experience by utilising natural language processing (NLP) to communicate with clients, respond to enquiries, and carry out regular tasks.

Banks and other financial organisations can increase customer care efforts without sacrificing quality by automating these exchanges.

AI & Data Analytics

Large datasets are processed by AI in data analytics to produce insights that can be put to use. It makes it possible for financial organisations to provide individualised services like credit scoring and customised investment suggestions.

In addition to facilitating targeted marketing strategies and improving the customer experience overall, advanced data analysis assists in identifying patterns in customer behaviour.

AI's predictive analytics enhance decision-making by identifying trends and evaluating risks, enabling companies to make informed financial decisions based on data.

Challenges of AI in FinTech

As companies work on integrating AI into their operations, it's crucial that they capitalize on the potential advantages while also addressing the risks involved.

This involves creating strategies that align with their goals, as well as regularly assessing the effectiveness of AI implementations to ensure they deliver the desired results.

Data Integrity and Accessibility

The quality and accessibility of data have a major impact on how well AI works in the FinTech industry. Inaccurate insights from low-quality data can have an impact on decision-making and customer trust.

Financial organisations frequently encounter challenges in obtaining current, pertinent data because of their outdated infrastructure and compartmentalised systems. Data integrity can only be guaranteed by stringent data management practices and technology investments to combine and purify data sources.

Navigating Regulatory Frameworks

Different jurisdictions have different regulations that control the financial sector. Adherence to these regulations is crucial in order to avoid legal consequences.

Regulators are constantly modifying guidelines to address possible dangers connected with AI usage, such as accountability and transparency, as the technology advances.

FinTech businesses need to be alert and flexible, and they frequently need specialised compliance teams to successfully navigate this environment.

Bridging the Talent Gap

The lack of trained experts with knowledge of financial services and AI technology is a major obstacle to putting AI solutions into practice. There is frequently a greater demand than there is supply for data scientists, machine learning engineers, and compliance professionals.

To develop the requisite skill pool, organisations must make investments in training initiatives and collaborations with academic institutions. Additionally, providing competitive pay and cutting-edge work conditions is constantly necessary to draw in top talent.

Addressing Ethical and Bias Issues

Through their training data, AI systems may unintentionally reinforce and reflect pre-existing biases. Particularly in lending and credit decisions, this may result in the unfair treatment of specific client groups.

Establishing frameworks that support equity, accountability, and transparency must be the top priority for financial institutions when it comes to ethical AI strategies. AI applications can be made to comply with ethical norms by using a variety of training datasets and conducting regular audits to reduce bias.

Interesting Examples of AI-Driven FinTech

Here are some notable examples of initiatives in AI-driven FinTech:

Upstart: Founded by ex-Googlers, Upstart integrates AI into every stage of the lending process, streamlining identity verification, fraud detection, and income and employment checks. This automation makes credit origination fast and seamless for both borrowers and lenders.

Chatbot KAI: Mastercard's chatbot "KAI" showcases the use of AI in customer support with account inquiries, transaction history, and expense tracking. Powered by ML and NLP, KAI provides personalized assistance and financial insights on multiple platforms, such as SMS, WhatsApp, and Messenger.

Plaid: Plaid enhances its data aggregation services using AI to securely connect users' bank accounts and deliver accurate financial insights, improving the overall user experience.

Conclusion

FinTech integration of AI offers great potential for progress, but it also brings a special set of difficulties that need to be handled with caution. FinTech companies can optimize AI's potential by tackling data quality, regulatory compliance, talent acquisition, and ethical considerations.

By demonstrating strategic vision and a dedication to responsible innovation, the financial services sector can overcome these challenges and open the door to a future in which artificial intelligence improves customer satisfaction and efficiency.