blog

AI in Banking: Transforming the Future of Financial Services

By Mohan S Software development Digital transformation AI and ML BFSI November 1, 2024

Artificial Intelligence is driving the banking sector into uncharted territories with its applications, such as enhancing customer service chatbots, combating fraud, and utilizing Gen AI to accelerate time-consuming tasks like coding, drafting pitch books, and summarizing regulatory documents.

Successfully deploying AI-enhanced tools and software could unlock significant value and, AI, so far seems to be the only technology that could entirely transform banking.

The Rise of AI in Banking

AI in banking is not new. BFSI has been in fact at the forefront of AI adoption owing to the need for high accuracy, automation and prediction for making crucial decisions.

You may also like to ride: Blockchain Technology in Banking

A survey by the World Economic Forum and the Cambridge Centre for Alternative Finance reveals that 85% of financial services organizations are already leveraging AI in some capacity.

In the past and even now, ML libraries like pandas, SKLearn, and TensorFlow enabled more advanced data processing and analytics. This shift has made AI more accessible, enabling banks to use models like Monte Carlo simulations and stochastic processes to improve financial analysis and decision-making.

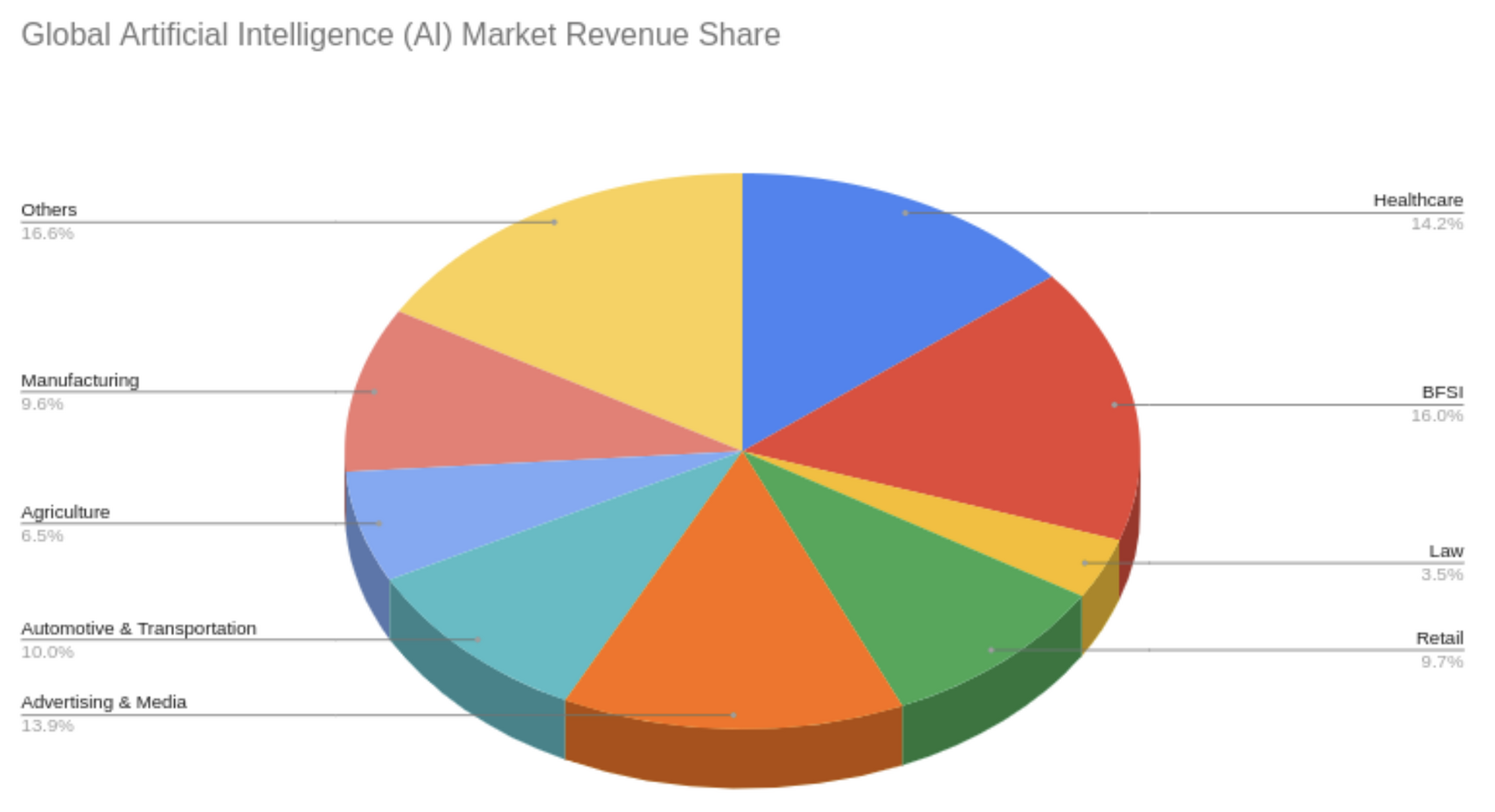

In 2023, the banking, financial services, and insurance (BFSI) sector led the world in AI-driven revenue, claiming the largest share of the global market.

(Source: https://www.precedenceresearch.com/artificial-intelligence-market)

Key Applications

Banks can utilise AI technologies to obtain important insights from massive amounts of data, as well as streamline their processes. This enables them to anticipate market trends, proactively handle potential risks, and customise their solutions to meet the demands of specific customers. As AI develops further, banks will be able to rethink what they offer and be flexible and responsive in a market that is becoming more and more competitive.

1. Customer Service Automation

AI has revolutionized customer service in the banking sector through the use of chatbots and virtual assistants. These AI-powered systems are designed to handle a wide range of customer inquiries, such as balance inquiries, transaction details, account openings, and more.

Examples and Impact: CIMB Singapore’s AI-powered chatbot exemplifies how financial institutions can enhance customer experiences by offering round-the-clock support. By integrating Natural Language Processing (NLP), the chatbot streamlines interactions, significantly reduces response times, and enhances customer satisfaction, allowing human agents to focus on more complex, value-added tasks.

Personalization and Efficiency: OCBC's generative AI chatbot, deployed globally to all employees, showcases how machine learning algorithms can enhance personalization and efficiency. By predicting customer needs and continuously learning from interactions, the chatbot improves service quality, increasing customer retention and loyalty.

You may like to read: Creativity as a means of success in an AI-powered future

2. Risk Management and Fraud Detection

AI has demonstrated its worth in two crucial areas: fraud detection and risk management. Artificial intelligence has transformed the time-consuming and reactive nature of traditional techniques of transaction monitoring and fraud identification by enabling a more proactive and efficient procedure.

AI Models for Fraud Detection: AI algorithms use real-time analysis to detect fraudulent activities in transaction data. They use pattern recognition, anomaly detection, and behavioral analysis to monitor customer behavior and flag unusual activity before causing damage.

Increased Accuracy and Reduced Losses: IBM's AI-driven fraud detection solutions improve accuracy, reduce false positives, and save banks millions of dollars annually, enhancing customer asset protection and trust building.

3. Credit Scoring and Loan Approval

AI uses large datasets and sophisticated algorithms to evaluate creditworthiness more thoroughly and fairly, reinventing the credit rating and loan approval procedures.

Enhanced Data Analysis: Traditional credit scoring models can be biased due to their reliance on credit history and financial information. AI models, however, can analyze broader data, making assessments more accurate and fair.

Quick and Accurate Loan Processing: JPMorgan utilizes AI-powered systems to streamline loan approval processes, reducing human error and identifying high-risk applicants. This not only speeds up the process but also maintains a healthier loan portfolio.

4. Personalized Banking Experience

This revolution in banking is led by AI, and AI-powered personalisation is a powerful tool for enhancing the client experience. AI technologies let banks provide customised goods and services by using consumer data to comprehend preferences, spending patterns, and financial objectives.

Tailored Recommendations and Services: HDFC Bank uses AI algorithms to create personalized investment recommendations based on customer transaction history, spending patterns, and demographic data, fostering customer engagement and encouraging them to explore more banking products.

Predictive Analytics for Customer Engagement: AI's predictive capabilities enable banks to anticipate customer needs, enhancing engagement, cross-selling opportunities, and customer satisfaction by analyzing historical data and predicting life events.

5. Operational Efficiency

AI’s impact extends beyond customer-facing applications to the core operations of banks. By automating back-office processes, AI significantly enhances operational efficiency and reduces costs.

Document Processing and Data Entry: AI algorithms speed up processing of paperwork like loan applications and compliance forms, while Optical Character Recognition technology streamlines workflows and minimizes manual input errors.

Compliance and Regulatory Monitoring: AI systems automate compliance monitoring for banks, reducing workload on compliance officers and allowing them to focus on risk management, thereby ensuring strict adherence to regulations.

Cost Reduction and Scalability: AI streamlines repetitive tasks, saving banks significant costs. Its scalability allows banks to expand services or enter new markets, allowing for cost management without additional human resources.

AI Implementation Challenges in Banking

There are many complex challenges to overcome in the process of integrating AI into banking operations, including technological, legal, ethical, and cultural issues. To effectively use AI, banks must overcome these complex challenges, which calls for a comprehensive strategy that blends creativity with a dedication to moral behaviour and compliance.

1. Data Privacy and Security Concerns

Challenge: The collection of sensitive customer data raises risks of data breaches and requires compliance with regulations like GDPR and CCPA.

Solution: Implement advanced encryption, multi-factor authentication, and AI-driven security systems to safeguard data and ensure regulatory compliance.

2. Integration Complexities

Challenge: Legacy systems in many banks are incompatible with modern AI technologies, requiring costly upgrades and complex integration processes.

Solution: Gradually transition to cloud-based architectures, allowing for better scalability and easier integration of AI solutions.

3. Regulatory Uncertainty and Global Differences

Challenge: Different regions have varying AI regulations, complicating compliance for global banks.

Solution: Invest in dedicated compliance teams and adaptive AI models that can adjust to different regulatory frameworks.

4. Cost and Resource Requirements

Challenge: High implementation and ongoing maintenance costs can strain bank resources, especially for smaller institutions.

Solution: Leverage partnerships with tech vendors for cost-sharing and consider scalable cloud solutions that reduce upfront investment.

5. Talent Shortage and Skills Gap

Challenge: There is a shortage of skilled personnel in AI, making recruitment difficult.

Solution: Develop in-house training programs to upskill existing employees and collaborate with educational institutions to cultivate new talent.

Understanding and tackling these issues will be essential for banks looking to stay competitive and responsive to their customers as the financial landscape changes.

Real-World Examples of AI in Banking

HSBC’s Use of AI for Fraud Detection: HSBC utilizes AI to monitor transactions in real-time, significantly reducing fraudulent activities by flagging suspicious behavior instantly.

DBS Bank’s AI-Powered Chatbot ‘DBS Digibank’: This chatbot handles over 80% of customer inquiries, showcasing the efficiency and scalability of AI in customer service.

Wells Fargo’s Predictive Banking System: Using AI to analyze customer spending patterns, Wells Fargo offers proactive financial advice and personalized services, enhancing customer engagement and loyalty.

Citi’s Advanced Risk Analytics Platform: CitiBank collaborated with EY and SAS to develop an AI-powered risk analytics scoring engine, streamlining processes for reviewing large trade transactions, reducing loan approval time, and enhancing risk assessment efficiency.

Conclusion

AI is changing the banking industry by offering previously unexplored chances for efficiency and creativity. With the right strategies in place, the finance industry can navigate this journey with ease. Banks must embrace and adjust to the ongoing development of AI in order to stay competitive and offer better customer service.

At Buuuk, we understand the transformative power of AI in banking. Let us help you leverage cutting-edge technology to enhance your banking solutions. Talk to us about how we can support your journey towards AI integration and operational excellence.